How Does Credit Card Payment Processing Work?

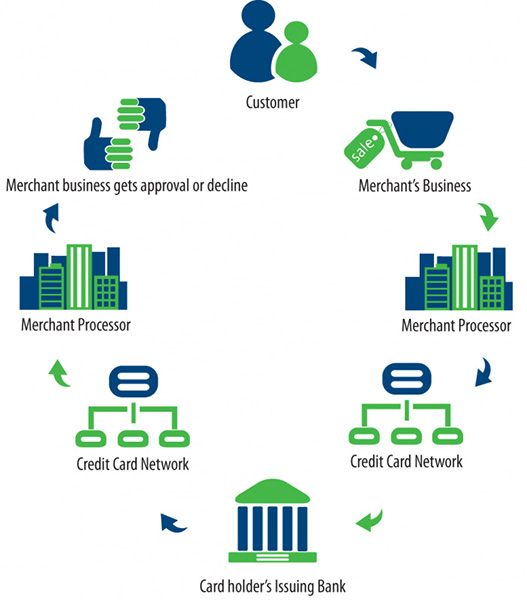

What looks like a transaction that takes seconds is actually far more involved than you might think.

Start by understanding the basics of credit card payment processing.

Understanding each step in credit card payment processing, from authorization to settlement, will help you leverage your payments to grow your business.

Credit Card Processing – Who Are The Key Players & What Do They Do?

Key Players

➢ There’s the Payment Processor like First Data, Elavon, and Global

➢ The Credit Card Brand like Visa, MasterCard, American Express or Discover.

➢ The Bank that issues the card to your customer.

➢ And you, the Merchant.

What Does Each Of The Key Players Do?

➢ The Credit Card Brands build and maintain the networks that allow your transactions to occur, and

➢ The Bank that issues the credit card that provides your customers with the funds for their purchase.

What Happens When You Accept A Credit Card?

You’ve probably wondered what happens from the time you accept your customer’s credit card to the time you receive payment.

Three Main Processes Take Place

1 - Authorization

Without Authorization you wouldn’t be able to accept debit and credit cards and that could mean lost sales.

Authorization confirms that the card number is a valid account number and that it has an available credit balance sufficient for the transaction.

Keep in mind that this does not mean that the transaction is valid or that it is being entered into by the actual cardholder or that it will not be disputed. There could be a chargeback even though an authorization was obtained.

You can obtain authorizations in several ways: through a point-of-sale terminal, your e-commerce Web site or by phone.

Generally, the authorization process occurs within a matter of seconds and follows these steps:

1. Your customer is ready to buy, and presents their credit card information to you. This can happen in person, by phone or online via your e-commerce site.

2. Next, you transmit this information to First Data, your payment processor — for example, entering the dollar amount of the purchase in your terminal and processing the credit card payment.

3. Your Payment Processor then forwards your customer’s card and purchase information to the Card Brand (such as Visa®, MasterCard®, American Express or Discover®).

4. The Card Brand sends this request to the Card Issuer (Remember – the card issuer is the bank that issued the card to your customer).

5. The Card Issuer approves or declines the transaction. This response is sent to the Card Brand (eg. Visa, Mastercard, American Express or Discover)

6. The Card Brand sends the response to your payment processor.

7. Your payment processor forwards this response to you (either via your card processing terminal, point-of-sale device, e-commerce site or verbally, by phone), so you can complete the transaction.

8. Finally, one of two things will happen: either the card will be approved and you will receive notification and an authorization number, or it will be declined or referred. See below to learn about approvals, declines and referrals.

Note: If you are a merchant with very large daily sales volumes, you may be able to send multiple authorization requests grouped in a batch once to several times daily, on line or over the phone.

Approval, Decline and Referral

Approval:

The dollar amount of the purchase, which you have submitted will be reserved from your customer’s available credit limit for future settlement.

Decline:

When your customer’s card cannot be used to complete the purchase.

There are many reasons why a card might be declined — for instance, a temporary situation such as a customer going over the credit limit, or another issue, such as when a card being lost or stolen.

It is not your responsibility to explain to your customer why his or her card was declined, you don’t receive the reason for the decline. If a customer insists on knowing why he or she was denied, that person should use the customer service contact information on the back of his or her credit card to get more information.

Referral:

A request for further information (either from the merchant or the cardholder) before issuing an authorization.

As a security measure, a Card Issuer may send your payment processor a referral response. Your payment processor will contact the Card Issuer and request an authorization for you. At this point, the Card Issuer may ask to speak to you or your customer over the phone to confirm the legitimacy of the transaction before authorizing. An example of when this might occur is if the cardholder is trying to use the card in a foreign country, is using his or her card more than usual in a short time period, or has reached their credit limit.

2 - Settlement

Settlement is the process of managing your electronic payment transactions so that they clear and are funded. To begin the settlement process, you, the merchant, must present approved card transactions to your payment processor. This is done through your terminal, your mobile app, or your virtual terminal. You may automate the settlement process, ask us how.

Your payment processor then submits your approved transactions to the payment brands (such as Visa, MasterCard or Discover) for clearing through interchange. These transactions are sometimes called “deposit” transactions.

Here Are The Steps In The Settlement Process:

➢ You, the merchant, submit your transaction data to your payment processor, like First Data, using your point-of-sale device or your online shopping cart to trigger a settlement.

➢ Your payment processor then forwards your settlement request to Visa, MasterCard, American Express or Discover (the Card Brands) for confirmation with the cardholder’s issuing bank.

➢ The Card Brand receives the settlement request and does the following:

➢Issues a credit to First Data, your payment processor, so they can reimburse you for the transaction amount. The issuer then pays your payment processor for the transaction.

➢ Issues a debit to the issuer to charge them for the transaction.

➢ The issuer then posts the transaction to the customer’s account.

➢ At the end of the billing period, the issuer sends your customer his or her monthly statement.

➢The customer receives his or her credit card statement and pays the bill (to the card issuer).

3 - Funding

In order to fund your designated account quickly, be aware that holidays and transaction deadlines may impact the funding process.

Let's Work Together

Get in touch and ask us for a quote or ask a question about what solution is best for your business. Call us at 888-616-6967 or click to send an email. We’re here to help.