Thinking About Switching Your Credit Card Processor?

Dissatisfied with poor and unresponsive customer service?

Frustrated because you’re unable to get the products and services you want?

…then it’s time to switch credit card processors.

⇒ Find out how much you’ll save and how easy it is to switch!

Start Accepting Debit & Credit Cards At A Lower Cost!

It Takes Only 15 Minutes to Apply

It only takes about 15 minutes to complete your application to open a merchant account, with fast approval time also.

Start Accepting Payments In 5 Days Or Less

Start accepting payments in 5 business days or less! Process your payments with ease, and get next day deposits.

Get The Ideal Payment Solution

Our payment industry experts will help you find the ideal payment solution for your business at the most competitive price.

Save Money On Every Transaction

At Canada First, our goal is to make it easy for you to understand your options and easy for you to decide. We want to empower your decision making and promise full transparency – no gimmicks and no hidden fees. The more you understand – the better we look.

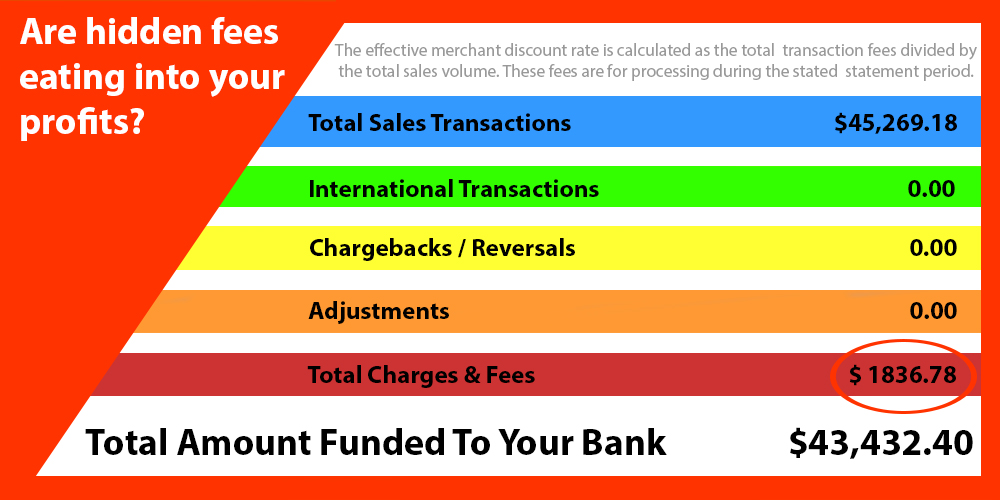

Transparent Credit Card Processing Fees

When you process credit card payments from your customers, hidden fees that you’re charged for debit and credit card processing eat into your profits. Confusing claims of discounts and non-standard merchant account pricing overwhelm business owners like you – who are trying to run, their business and earn a decent living.

At Canada First, our goal is to help you understand exactly what you’re paying for and why. We promise complete transparency in our pricing. No hidden fees and no gimmicks. We help you save money on your debit and credit card processing. It’s that simple.

The merchant services industry is highly competitive. There are many opportunities for businesses like yours to find better rates and deals from other providers. However, it is a good idea to be cautious when it comes to changing providers. Be sure to check for the following details before making a switch.

Check The Following Details Before Making The Switch….

Understand Your Current Contract

When signing up with a merchant service provider, you’ll typically sign a contract. Some contracts are for a certain length of time (2, 3 or 4 years) and upon completion move to a month-to-month structure. Some contracts have early cancellation penalties. Some have automatic renewal clauses. The best contracts, allow you to cancel at any time and have no cancellation penalties. Before you try to switch, check to see what kind of contract you have with your current processing provider.

There are ways of getting out of your contract without penalty. At Canada First, we’ll be happy to advise you on how to best manage the cancellation of your current contract so that you don’t incur any penalties – give us a call at 888.616-6967.

Find Out Whether You Own Or Lease Your POS System or Credit Card Terminal

It’s important to find out whether your equipment is leased or owned, Contact your credit card processor and confirm which is true for your account. If your current credit card machine was provided to you for free, most likely the credit card processor will request that you return it. If you fail to return the device, the credit card processing company will typically charge you for the terminal at a much higher cost than the terminal is actually worth.

Gift and Loyalty Cards

If you use gift and loyalty cards for your customers and these are provided by your current merchant service provider, be sure to verify these programs are transferable to your new credit card processing provider. If the cards you have will not work with your new processing provider, be sure to put a plan in place to transition to a new gift or loyalty program and alert your customers to the switch.

Verify Your New Rates And Equipment

When you contact a new credit card processing company ask about their fee structure. Also ask for a comparison of their rates with what you’re currently being charged so that you have a firm grasp of your savings.

At Canada First we’re happy to compare your current processing statement with what it would cost you if you processed with us for the same volume of transactions. That way, you’ll always be confident that you’re getting the absolutely best processing rates for your business.

Also keep in mind that switching to a new credit card processing provider offers you the opportunity to update and upgrade your equipment. Your new provider may have equipment that is different from what you have used in the past, so be sure to ask any and all questions that you might have concerning upgrading your equipment. This will ensure that you have the most cost effective and efficient credit card processing machines for your unique business needs.

Ask About And Confirm Any Special Offers

When looking for a new credit card processing provider check to see whether they offer any incentives for signing up with them. Such incentives might include free processing terminals, or a cash back.

Free Account Review

Canada First can help review your current credit card processing set up, discuss the most cost effective options for your business, and give you a Free Quote. We’ll do a free analysis of your current rates and fees, as well as your equipment setup to show you how we can save you time and money.

Credit Card Processing Options

Your Canada First Merchant Account Advisor will provide you with recommendations for processing options that can benefit the unique needs of your business. For example, if you have an on-the-go work force, the addition of mobile credit card processing will allow them to collect payment in the field, eliminating the need to bill and collect from customers at a later date. If you’re thinking about expanding your retail business to the internet, we can suggest online credit card processing options to help make it happen!

Secure and Affordable Credit Card Processing

You owe it to yourself and your business to make the right credit card processing choice: one that will meet your needs at a price you can afford. You shop around for the best deal from other suppliers and vendors — shouldn’t you do the same when it comes to your merchant account provider?

If you want cutting-edge, secure credit card processing technology and top-quality, 24/7 based customer service contact Canada First today for more information.

Making The Switch

Once you have verified the rates of your new merchant service provider and validated the terms of your old payment processing services, switching is easy and painless. Just give us a call at 888.616-6967 and we’ll make the process easy for you.

Accept All Types of Payment With A Single Merchant Account

Let one of our payment advisors guide you. We’ll help you choose the most cost effective, customized credit card processing solution for your business.

Contact us at 888-616-6967 or learn more by using our handy quick links.